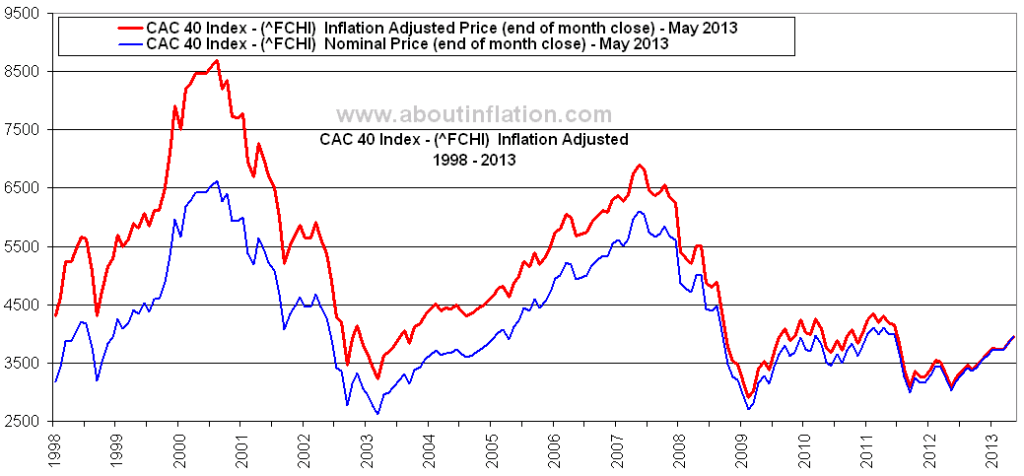

The chart is of the French CAC index, a mirror of the DJIA

It didn’t start out well this morning listening to CNBC. The first words I heard were “sector diversity”. What they mean by that of course are stocks grouped by category like industrials, banking, retail, transportation, etc. All you have to do is look at 100 year charts of the market. 2001 and 2008 being prime examples. There was no protection through diversification, everything crashed. Stocks, bonds, metals. There was no difference growth and value stocks. Large caps and small caps all crashed. There were no safe havens in overseas stocks. Every chart could be laid on top of the other.

Then I realized that every show on CNBC is like every financial show you hear on the radio: they’re all liars. Because they fail to address the 1 issue that matters. With 0 to near 0% interest rates the past 20 years (thus destroying bonds and cash as investment options), the Federal Reserve has removed 2 legs of the investment stool. Because there is no longer any competition for the investment dollar, there is nothing to hold stocks in-check.

Because there is no longer anywhere for money to flee, stocks have gone rogue. No dividends, no innovation and nothing but stock buy-backs benefitting senior management. And because these shows fail to address the ONE issue that matters, everything else they say is bullshit. There has to be competition. It is so basic. So fundamental. But they want to ignore the elephant in the room. You can’t throw out the window the principles of borrowing and lending. That is the basis of all business.

You destroy the most basic principle of business, the relationship between borrower and lender (with 0% interest rates), and you expect everything to work right? On top of this is the preposterous notion that a central bank can set the interest rates more knowledgeably than the market?? That is so ignorant its incomprehensible.